Before that life insurance agent approaches you with a shiny brochure full of confusing insurance products, it’s crucial to understand one key concept:

Wealth creation is not the same as wealth protection.

Understanding this difference can save you years of poor returns and financial regret. In this guide, we break down these two pillars of financial planning—wealth creation and wealth protection—and explain why mixing the two is a costly mistake.

💰 What Is Wealth Creation?

Wealth creation refers to the process of saving and investing your money with the goal of building financial security and growing your assets over time.

Common Wealth Creation Tools:

- Stocks

- Money Market Funds (MMFs)

- Bonds

- Exchange Traded Funds (ETFs)

- SACCOs

- Real estate

- Business ventures

The goal here is to earn solid returns, outpace inflation, and gradually build financial independence.

🛡️ What Is Wealth Protection?

Wealth protection is about safeguarding what you’ve already built—protecting yourself and your loved ones from financial shocks due to illness, accidents, or death.

Common Wealth Protection Tools:

- Health insurance

- Life insurance

- Income protection insurance

- Disability cover

- Critical illness cover

⚠️ Why You Should Never Combine the Two

Most insurance agents will try to sell you products that combine wealth creation and wealth protection. The most common ones are:

- Education policies

- Endowment policies

- Whole life policies with cash value components

While these products may seem like a win-win, they usually fail at both purposes.

🚫 The Problem With Combined Products

1. Low Returns

Most endowment and education policies offer returns as low as 4%–6% annually, which is below inflation and significantly lower than what you’d earn through other investment vehicles.

2. Inadequate Insurance Cover

Because the product is trying to build savings and provide insurance, the life cover amount is often too low to be meaningful, leaving your family underinsured.

3. Heavy Penalties for Early Withdrawal

If you cancel your policy before 3 years, you’ll likely lose everything. After 3 years, there may still be penalty deductions depending on the terms.

✅ What to Do Instead: Separate Your Strategies

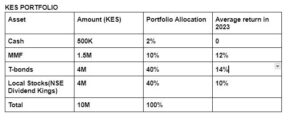

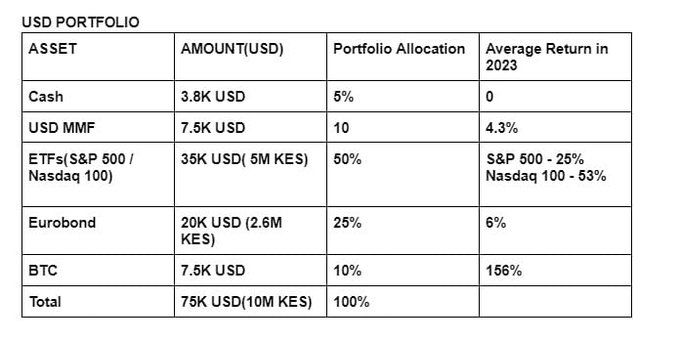

Wealth Creation Portfolio

Focus on tools that give you:

- Decent long-term returns

- Liquidity

- Currency diversification (e.g., KES vs USD investments)

Wealth Protection Portfolio

Choose insurance products that focus purely on risk coverage like:

- Whole life insurance

- Health insurance with adequate coverage

A good whole life cover should include essential riders:

- Critical illness rider: Pays a lump sum if the policyholder is diagnosed with a serious condition.

- Accident benefit rider: Pays a lump sum if the policyholder becomes permanently disabled due to an accident.

Want a quote? Fill out this form to get a whole life insurance estimate sent to your email:

👉 https://forms.gle/JmJUmBkjiVmbF9

🎯 Final Thoughts

To achieve financial success, treat wealth creation and wealth protection as two separate but equally important components of your financial plan.

Build wealth with smart investments. Protect wealth with proper insurance.

📩 Get More Financial Wisdom

If you found this helpful:

✅ Follow me on Twitter: @NewsikaKenya

✅ Join my newsletter for more insights: bit.ly/4ec7U3i

🎓 Money Mastery Masterclass – November Cohort Now Open!

Take your financial literacy to the next level. Our Money Mastery Masterclass is now accepting enrollments for the November session.

🎓 Learn about:

- Budgeting

- Investing

- Debt management

- Insurance strategy